1.3 Bridging the Deductible: Why GAP Insurance is a Smart Strategy for Small Businesses

Small businesses often face a tough balancing act: controlling health insurance costs while ensuring employees are protected from high out-of-pocket expenses.

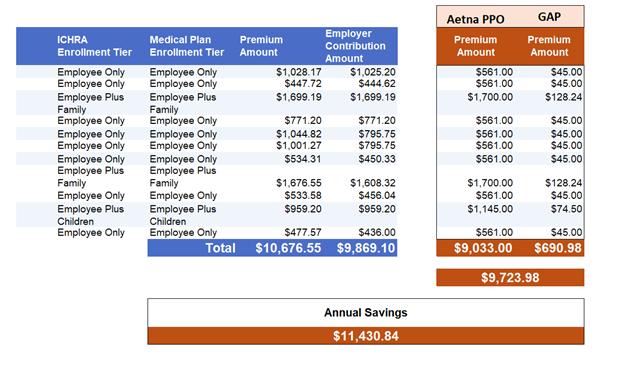

We recently helped an 11-employee company save over $11,000 annually—all while dramatically reducing employee deductibles—by pairing a High-Deductible Health Plan (HDHP) with a GAP insurance policy.

This strategy is a proven way to

maximize savings for the employer while keeping

employee costs predictable and manageable.

🧩 What Is GAP Insurance?

GAP insurance is a

supplemental health policy designed to cover the “gap” between what an HDHP pays and what employees owe out-of-pocket. Typically, it reimburses:

- Deductibles

- Copays

- Coinsurance

- Hospital stays or surgeries

Think of it as a

financial airbag, softening the blow of large medical expenses before the HDHP kicks in. The best part? Coverage can be

surprisingly affordable, often starting around

$40/month for an individual.

✅ Benefits of GAP Insurance Strategies

- Reduce Out-of-Pocket Exposure: A $7,150 deductible can feel more like $2,000, making care accessible and less stressful for employees.

- Employer Cost Savings: HDHPs have lower premiums, and when paired with GAP, employers can save thousands annually.

- Customizable Coverage: GAP plans can cover inpatient, outpatient, ER visits, or even select prescriptions.

- Predictable Budgeting: Simplifies forecasting while maintaining strong employee protection.

- Recruitment & Retention Tool: Employees value affordable premiums and lower deductibles, improving morale and loyalty.

⚠️ Considerations and Limitations

While GAP insurance is powerful, small businesses should be aware of potential challenges:

- Claims Submission: Employees may need to submit EOBs and receipts for reimbursement.

- Limited Mental Health Coverage: Many GAP policies exclude behavioral health or therapy.

- Communication Complexity: Employees require clear guidance to understand how GAP works with their HDHP.

🏆 Why This Strategy Works

Using a PEO Master Aetna HDHP paired with GAP insurance provides a textbook example of a win-win benefits strategy:

- Lower employer premiums without sacrificing coverage

- Protect employees from large deductibles

- Provide affordable coverage starting as low as $40/month per employee

- Build a cost-effective, competitive benefits package

For small businesses, this combination strikes the perfect balance between savings and employee satisfaction, while helping HR teams manage renewals during Q4 efficiently.

📩 Next Steps

Want to explore how GAP strategies could work for your business? We provide free, side-by-side comparisons tailored to your company.

Email:

suzanna@peofortheceo.com to get started today.

Stay Tuned

In the next article in our Q4 series, we’ll cover:

“HRA vs. HSA: Smarter Cost Containment Strategies for Employers”

We’ll dive into the

differences, benefits, and best practices for using HRAs and HSAs to

control healthcare costs while keeping employees happy.