1.0 Why Q4 Matters More Than Any Other Time

Did you know that 85% of businesses renew their group medical insurance in the fourth quarter? For HR teams and business owners, this period can feel overwhelming—especially as premiums continue to rise by double digits.

If you’re looking to

control costs, maintain employee satisfaction, and maximize benefits, this is the perfect time to explore

creative strategies like PEOs (Professional Employer Organizations).

Why Q4 Matters More Than Any Other Time

The concentration of group medical insurance renewals in Q4 isn’t random. Many insurance carriers align plan years with the calendar year, making the last quarter the busiest time for:

- Adjusting premiums

- Negotiating plan changes

- Reviewing employee eligibility

- Ensuring ACA and compliance requirements are met

If you wait until the last minute, you risk paying higher premiums and missing opportunities for smarter strategies to save on group health insurance.

Waiting until the last minute can result in:

- Higher premiums due to limited negotiating leverage

- Administrative overload for HR teams managing renewals, compliance, and employee communication

- Missed opportunities to explore alternative funding models or creative cost-saving strategies

Put simply: what you do (or don’t do) in Q4 directly impacts your costs, your benefits, and your competitiveness in 2025.

How Smart Businesses Stay Competitive

Forward-thinking companies know that Q4 isn’t just about signing the dotted line—it’s about using renewal season as a strategic opportunity. Here are a few of the most effective strategies, which we’ll explore in depth in upcoming articles:

1.1 The PEO Advantage

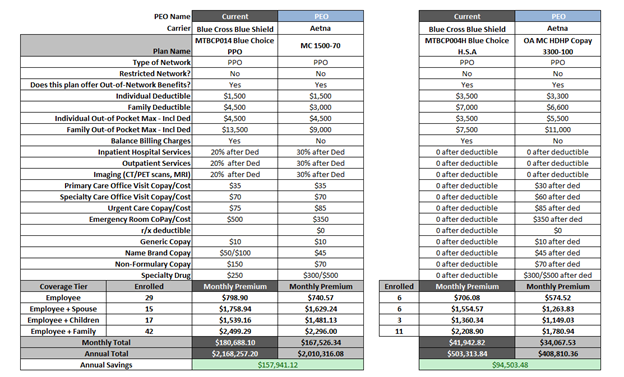

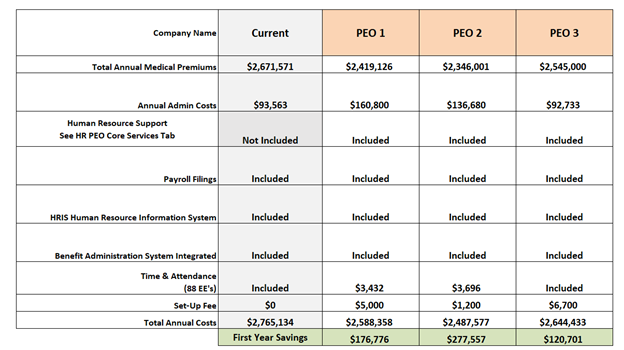

Joining a Professional Employer Organization (PEO) can plug your business into a large group master health policy, often delivering 15%–35% premium reductions while bundling HR, payroll, and compliance support.

1.2 Level-Funding

This increasingly popular approach blends the predictability of fully insured plans with the cost-savings potential of self-funding. But are businesses really saving money? In our next article, we’ll break down the pros, cons, and real-world savings examples.

1.3 GAP & HRA Strategies

GAP coverage and Health Reimbursement Accounts (HRAs) can dramatically reduce employee out-of-pocket costs while helping employers lower total healthcare spend. We’ll share

real-world examples and scenarios where these strategies make sense.

Professional Employer Organizations (PEOs) are a powerful solution for businesses that want to reduce costs and simplify HR administration.

Why PEOs make sense for Q4 renewals:

- Leverage large-group buying power to access better rates on health insurance

- Streamline compliance with ACA, COBRA, and state-specific regulations

- Reduce administrative workload for HR teams

- Potential for six-figure savings on healthcare costs

For example, we recently worked with a 125-employee company and helped them save over $250,000 annually—all while maintaining their employee benefits. That’s the kind of impactful savings that can transform a company’s bottom line.

Trusted Advisor Tips for Q4 Renewals

As a trusted PEO broker, here’s how we guide clients through the Q4 renewal process:

- Start early: Begin reviewing your group medical insurance options before October.

- Compare multiple PEOs: With over 600 PEOs nationwide, side-by-side evaluations help find the best fit for your business.

- Evaluate funding models: Fully insured, self-insured, and level-funded plans each have pros and cons.

- Review employee satisfaction: Don’t sacrifice benefits—your employees’ experience matters for retention.

- Leverage your broker: An experienced PEO broker provides unbiased guidance and ensures you capture savings without risk.

Real-World Impact: How Q4 Planning Saves Money

Strategic planning in Q4 can lead to substantial savings. Whether it’s switching to a PEO-managed health plan, exploring level-funded options, or optimizing benefits administration, businesses that plan ahead see measurable results.

For HR leaders, CFOs, and business owners, these savings aren’t just numbers—they mean

more resources to invest in growth, hiring, and employee engagement.

Final Takeaway

Q4 isn’t just renewal season—it’s your opportunity to reset your benefits strategy. Whether through a PEO, level-funded plan, or GAP/HRA strategies, there are proven ways to cut costs, streamline administration, and strengthen your employee value proposition.

Stay tuned for the next article in this series:

“1.1 The PEO Advantage: How Large Group Policies Drive Big Savings”

About Suzanna Martinez

Suzanna Martinez is the founder of PEO For The CEO, bringing

20+ years of experience working for multiple PEO companies.

She has guided hundreds of businesses in Georgia and Colorado

to streamlined HR operations and significant cost savings.

Suzanna specializes in negotiating large-group health insurance

rates and matching businesses with the right PEO partner.