PEO for the CEO is a free, vendor-neutral PEO broker serving businesses in Georgia, Colorado and nationwide.

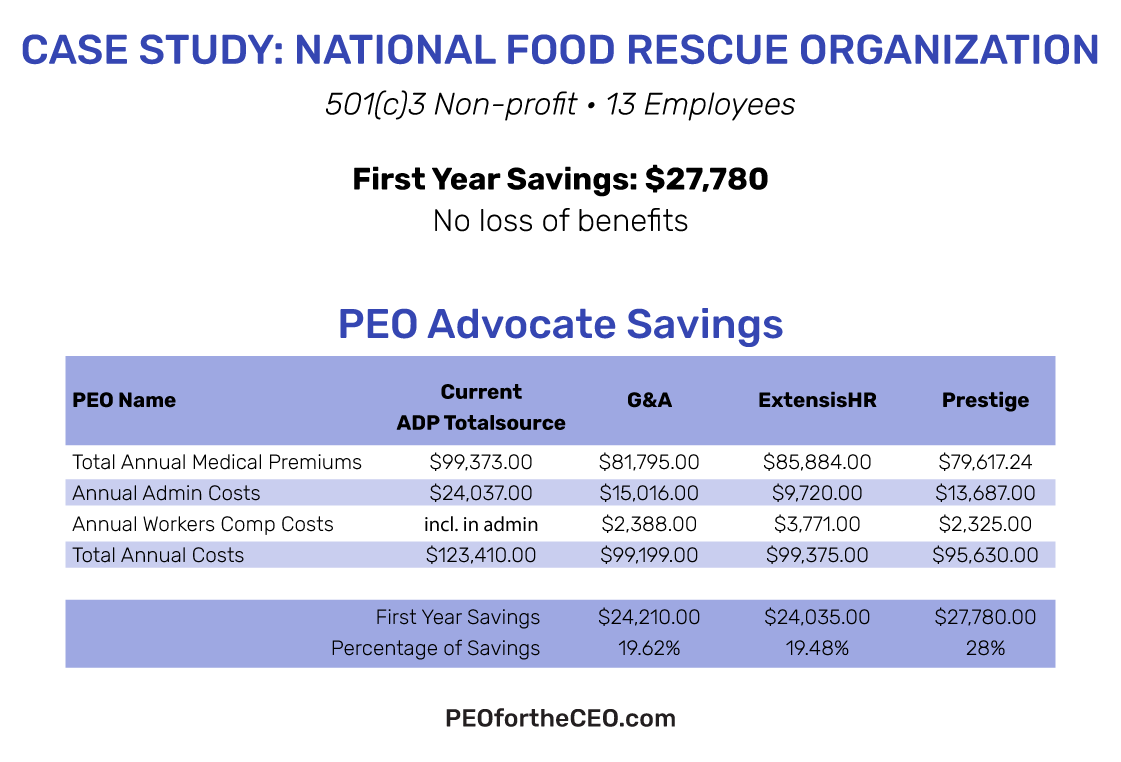

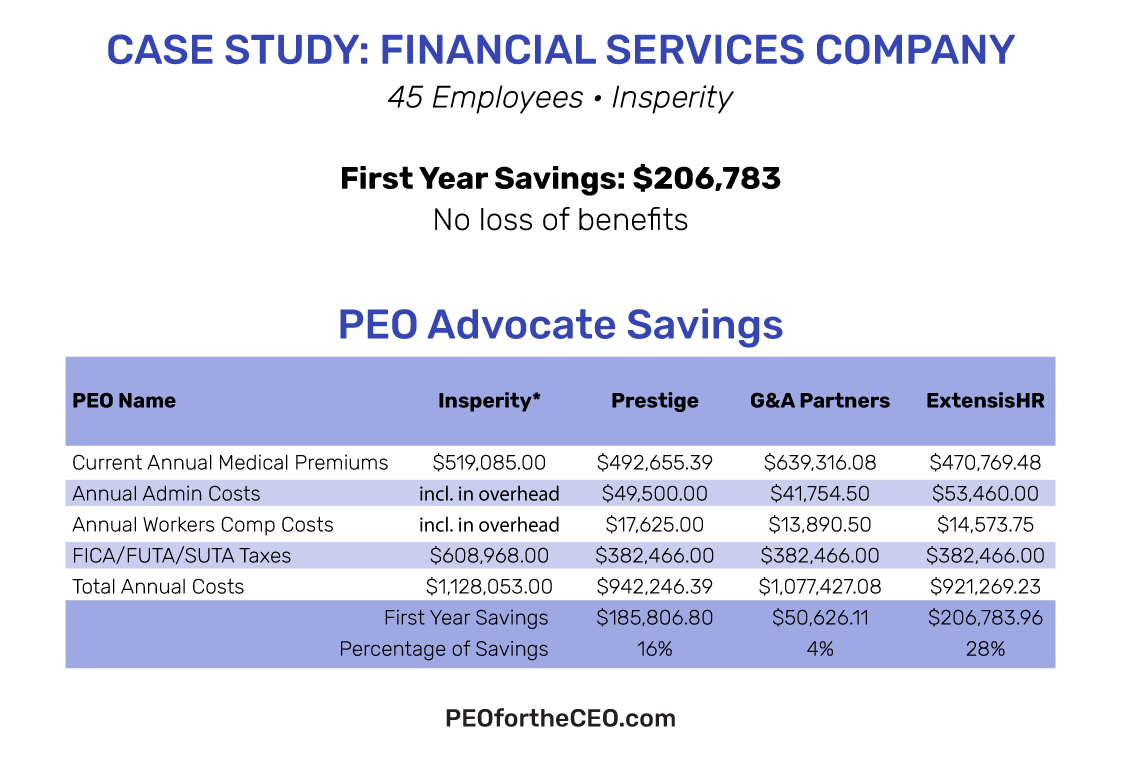

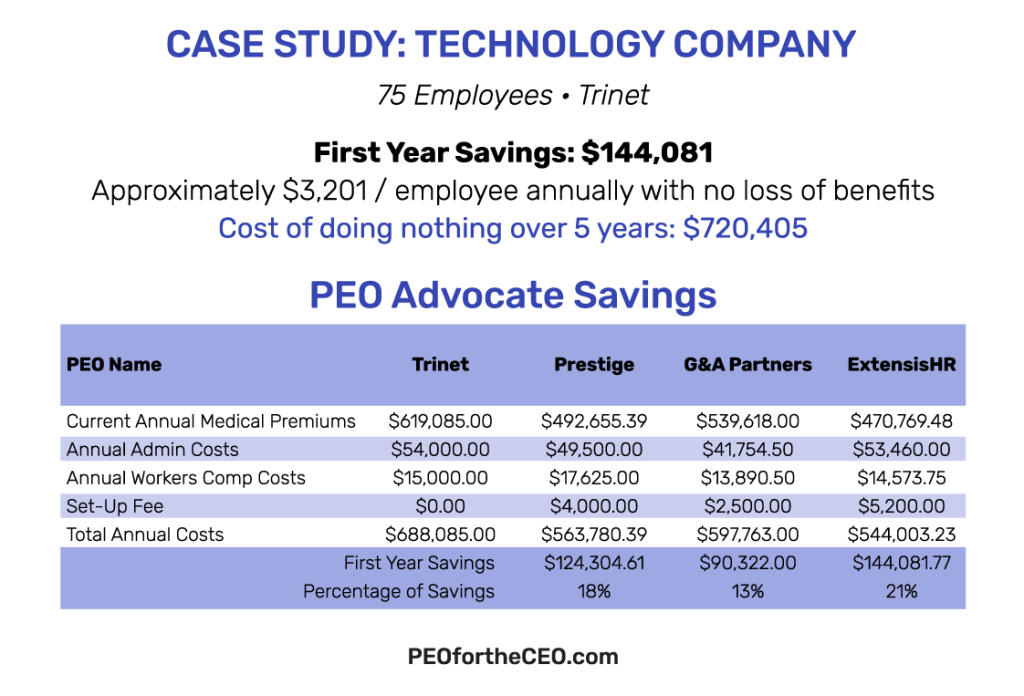

We compare multiple PEO providers side-by-side, typically saving clients 20-40% on health insurance premiums.

With 20+ years in the PEO industry, we handle the research and negotiations so you can focus on running your business.

According to NAPEO (National Association of Professional Employer Organizations), businesses that use a PEO:

- Grow 7-9% faster than competitors

- Have 10-14% lower employee turnover

- Are 50% less likely to go out of business

Our clients typically see 20-40% savings on health insurance premiums by accessing large-group rates through PEO master policies.

What Does a PEO Broker Do and Why Do I Need One?

We Help You Choose the Right PEO Partner

We guide businesses in selecting the best-fit PEO to streamline HR, payroll, benefits, and workers’ compensation—while uncovering significant cost savings.

Free Consultation

Our services come at no cost to you. We're paid by the PEO providers, so you get expert advice without the added expense.

Vendor Neutral

We work solely in your best interest—comparing multiple providers objectively to find the right solution for your company’s needs.

Industry Expertise

With over 20 years of experience in the PEO and employee benefits space, we bring deep insight, trusted relationships, and proven results to the table.

We Do the Heavy Lifting

From collecting competitive proposals to analyzing options side-by-side, we handle the process so you can focus on running your business.

How Much Can a PEO Save My Business?

What Services Are Included When You Partner With a PEO?

Risk & Compliance Services provides comprehensive protection and guidance, from Employment Practices Liability Insurance (EPLI) to Affordable Care Act compliance. We ensure your business stays compliant with federal and state employment laws through expert training, claims management, and essential documentation support.

Employee Health Insurance & Benefits Services delivers top-tier coverage, including medical, dental, vision, and life insurance, alongside flexible spending and health savings account administration. Enhance your workforce's well-being with comprehensive benefits, 401(k) setup, payroll contributions, and exclusive employee perks.

Workers' Compensation Services ensures industry-specific assessments, effective claims management, and expedited resolutions, all while preventing fraud and eliminating year-end audits. We enhance workplace safety through hazard identification, tailored programs, and comprehensive training resources.

Our comprehensive technology platform streamlines HR operations with employee and manager self-service tools, from online onboarding and benefits enrollment to time tracking and performance management. Gain efficiency and insights with features like applicant tracking, compensation benchmarks, and detailed HR reports.

HR services provide seamless employee onboarding, strategic benefits funding guidance, and a comprehensive employee solution center. We ensure compliance through best practices reviews and optimize workforce potential with thorough human capital assessments.

Payroll services ensure accurate and timely payroll processing, including tax filings and compliance, wage garnishments, and direct deposit management. Streamline your payroll operations with automated solutions and dedicated support for all your payroll needs.

Frequently Asked Questions About PEO Brokers

What is a PEO broker?

A PEO broker is an independent consultant who helps businesses compare, evaluate, and select the best Professional Employer Organization for their specific needs. Unlike working directly with a single PEO, a broker compares multiple providers to find the optimal fit.

How much does a PEO broker cost?

PEO broker services are typically free to businesses. Brokers are compensated by the PEO providers when a client signs a contract—similar to how insurance brokers work.

What's the difference between a PEO and a staffing agency?

A PEO creates a co-employment relationship where your employees remain your employees, while the PEO handles HR, payroll, and benefits administration. A staffing agency provides temporary workers who are employees of the agency, not your company.

How long does it take to switch to a PEO?

Most PEO implementations take 30-60 days from contract signing to go-live, depending on the complexity of your payroll and benefits setup.

Does a company save money by using a PEO broker versus going directly to a PEO?

You certainly can go directly to a PEO company. However, working with a PEO broker typically results in better outcomes—and often meaningful cost savings—at no cost to you.

A PEO broker helps you shop and compare multiple vetted PEOs side-by-side, negotiates pricing and contract terms on your behalf, and leverages established relationships and volume discounts that are not generally available to companies going direct.

PEO Partners

Client Testimonials

Let's Work Together!

A PEO streamlines HR operations, saving time and money for company leaders by consolidating back-end tasks and enhancing efficiency.

Let’s start your no-obligation PEO analysis today!

About Suzanna Martinez

Suzanna Martinez is the founder of PEO For The CEO, bringing 20+ years of experience working for multiple PEO companies.

She has guided hundreds of businesses in Georgia and Colorado to streamlined HR operations and significant cost savings.

Suzanna specializes in negotiating large-group health insurance rates and matching businesses with the right PEO partner.